Gambling Winnings Self Employment Tax

Editor’s note: The following is not to be construed as tax advice. Always consult a tax professional before filing.

- Gambling Winnings Self Employment Tax Calculator

- Gambling Winnings Self Employment Tax Form

- Gambling Winnings Self Employment Tax Rules

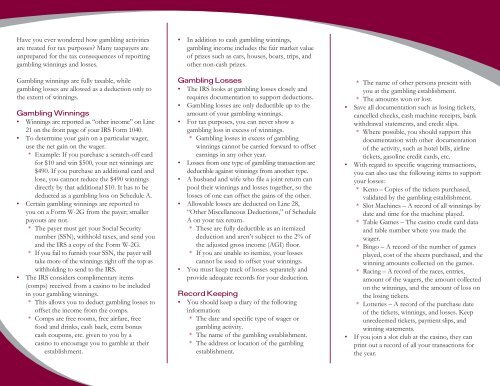

Whether it's $5 or $5,000, from an office pool or from a casino, all gambling winnings must be reported on your tax return as 'other income' on Schedule 1 (Form 1040), line 8.If you win a non-cash. Pro gamblers claim winnings on Schedule C as a self-employed person rather than as other income on Form 1040. Even as a professional, you can’t deduct more losses than winnings in a year. You’re stuck in a tough situation with treating gambling as a day job, yet not being able to file losses that exceed winnings. Recently the IRS notified me that they changed my 2005 return. They took my gambling winnings of $60,000, which I had indicated on line 21 (Other Income), and decided to call this self employment income. The result is a new tax bill of $8,000. IRS specifically states in their tax guide that.

Gambling has begun to proliferate throughout the US. Sports betting in particular has taken off in multiple states. And with the expansion of gambling comes (hopefully) a flurry of wins for new and seasoned gamblers alike.

If you’re lucky enough to win any amount of money gambling–whether it’s at a casino, a sportsbook, or elsewhere–it’s important to brush up on tax laws. Gambling winnings are taxable income, but they aren’t subject to the same tax rules as your normal income.

Though they can seem a bit daunting at first, taxes on gambling winnings are fairly easy to understand with a little help. Here’s a top-level guide that can help you get started.

All Gambling Winnings Are Taxable

Yes, all of them. Fantasy football winnings, slot machine jackpots, scratch-off tickets, poker tournament payouts…it’s all taxable.

Essentially, anything you win from a game of chance is subject to be taxed. One common misconception is that winnings are only taxable beyond a certain threshold. This is untrue. Instead, gambling institutions (casinos, race tracks, sportsbooks, etc.) have thresholds that determine when they issue you specific tax forms.

To put it simply, whether you win $100 or $10,000, you need to pay taxes on those winnings.

In most cases, federal taxes on gambling winnings are 24%. Penalties can apply if you pay late or don’t report the winnings, though, so be diligent about tracking and reporting your earnings.

Form WG-2 For Big Wins

If you hit a big win, most gambling establishments will automatically give you a W2-G tax form. The threshold for receiving a Form W2-G varies based on the type of gambling and the amount you won. Here are the thresholds:

- Sports betting and fantasy sports (DFS included): $600

- Bingo and slot machines: $1,200

- Keno: $1,500

- Poker tournaments: $5,000

Table games–blackjack, craps, sic bo, baccarat, etc.– are exempt from Form W2-G rules. You still need to report your winnings, but you won’t receive a special form.

Gambling Winnings Self Employment Tax Calculator

Lottery is absent from this list because the tax codes surrounding Powerball or other big lotto prizes can get more complex. If you win big on a lottery game, it’s best to get in touch with an accountant or tax service to assist you.

Online Sports Betting Wins: Form 1099

For sports bettors, the IRS Form 1099 will be the most common tax form. When you win more than $600 on a sportsbook site such as DraftKings, FanDuel, or PointsBet, the operator is required to send you a Form 1099-MISC. If you cash out those winnings with PayPal, you’ll get a Form 1099-K instead. Either way, this form helps you easily include your winnings with your yearly tax return.

Once again, remember that you’re still obligated to report your winnings even if you don’t receive a form from the sportsbook where you won money. They are only required to send you the form if you win more than $600. Winnings below that are still taxable; you just need to report them on your own.

Keep Track Of Your Wins

If you win money gambling, it’s crucial to keep a record of your wins and relevant information to make filing your taxes easy. To get started, keep track of the following information for each win:

- Win amount

- Original bet

- Type of gambling (online sports betting, Daily Fantasy Sports, slots, etc)

- Where you won (if online, name of the service/betting platform)

- Witnesses to your win, if applicable

- Tax forms give to you by the gambling institution, if applicable

This will help you file your taxes without needing to backtrack and find this information when it comes time to submit your info to the IRS.

You Can Deduct Losses, But There’s A Catch

The flip side of gambling winnings is, of course, losses. If you lose money gambling, you can deduct those losses when you file your tax return. But there are a few stipulations:

- To claim gambling losses as a deduction, you must itemize your deductions.

- You can only claim losses up to the winnings you claimed.

That first point (itemizing your deductions) means you can’t claim the standard deduction when you file your taxes. In many cases, itemizing just to claim a few gambling losses will end up losing you money on your tax return. It’s only advised to take this route if you already itemize your deductions.

The second point brings up another important point. If you won a total of $3,000 but lost $6,000 gambling, you can only deduct up to $3,000.

In other words, you should carefully consider the value of deducting your gambling losses. It can be helpful if you lost a significant chunk of money, but in many cases, it isn’t worth your while. If you’re unsure about whether to deduct gambling losses, I recommend contacting a tax professional.

Different Rules For Professional Gamblers

:max_bytes(150000):strip_icc()/200220872-001_HighRes-56a31b6f5f9b58b7d0d06263.jpg)

If you make your living gambling, most of the above rules don’t apply to you. When gambling is your full-time job, you can instead file as a self-employed person. You’re still subject to taxes on your winnings, but they are treated as normal income instead of gambling winnings.

Professional gamblers can also deduct certain costs as business expenses, lowering potential tax payments. This includes a percentage of your internet bill (if you gamble primarily online), travel expenses if you fly or drive to tournament locations, and other related costs.

Professional gambling makes the tax process look much different. If you fall into this category, finding a solid online tax platform or a tax advisor is a great course of action. These rules only apply to true full-time, professional gamblers. Otherwise, you could fall within the IRS rules for hobby losses, which can open you up to audit and increased taxes and penalties.

Gambling Winnings Self Employment Tax Form

State Taxes Vary

Gambling Winnings Self Employment Tax Rules

While I’ve covered federal taxes here, it’s also important to find your state’s laws with regard to gambling winnings and taxes. Check with your state’s tax organization to find out which taxes you’re subject to in your jurisdiction.