Blackjack Average Hands Per Hour

- Blackjack Average Hands Per Hour Table

- Blackjack Average Hands Per Hour Crossword

- Blackjack Average Hands Per Hour Poker

- Blackjack Average Hands Per Hour Online Poker

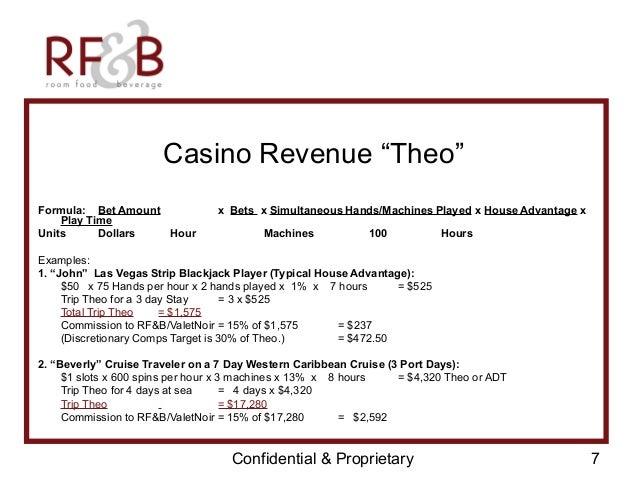

Royals account for about 2 percent of your overall payback, so in the average session you're seeing more like a 2.5 percent house edge. Also, video poker plays much faster than blackjack - about 500 hands per hour in video poker, 50 per hour at a full blackjack table. So in an average hour, you'll lose money much faster at video poker. Dec 08, 2016 This is also how I got my estimates for the DD game (per my post above). I noted a shuffle about every 5 minutes, 12 per hour. So I multiplied 12 times the theoretical number of hands per shuffle based on number of players and penetration. Apr 03, 2013 Hands per hour can be dealer dependent as some are faster and more dexterous than others. Other factors are number of players at the table, side bets, players' decision times etc. I regularly play over 200 hands per hour one on one. Wong did some studies on this subject using Atlantic City six deck games. Jun 20, 2005 The first set applies before she checks her hole card to see if she has blackjack. The numbers in parentheses tell you where she's at if she doesn't have blackjack. As you can see, a player's 19 would be the favorite over both a dealer's 10 and Ace if she has to play her hand out against yours.

Many gaming executives might mistakenly believe that optimal utilization of a gaming table is a simple function of getting as many people as possible to crowd around a single gaming table and wager as much as possible.

At first glance, this might appear to be the most efficient utilization of floor space and labor. This logic appeals even more in times when managers are being asked to trim their operating costs. This can occur when management is under short-term profit pressure and is looking wherever it can to enhance overall performance.

The major costs in most casino operations are gaming tax, labor and complimentary benefits to players. These often make up around 80 percent of direct operating costs in a casino’s table game operation and, as such, come into focus in times of economic downturn when greater efficiencies are being sought.

As gaming tax is generally unavoidable as a percentage of win, and player complimentaries-when properly administered-are a marketing cost that helps drive business, it is often direct gaming labor that receives the greatest scrutiny. It is the “most variable” of the variable costs.

However, though it may seem counterintuitive, optimal table game utilization is not necessarily a function of having every available position at every open gaming table occupied by customers. Indeed, that could quite possibly be a long way from the optimal outcome; the labor cost savings might be more than offset by foregone table game winnings.

Targeting 100 percent gaming position utilization may be the best way to reduce labor costs, but it may also sacrifice the highest possible yield in profit from a given set of customers. This might be paralleled to a farmer maximizing the yield per tractor in harvesting his fields, but leaving much of the crop to rot because the few tractors in use could not get to some of the farmland.

Reaching Optimal Utilization

Determining optimal utilization per table can be approached as a scientific question. This analysis attempts to do so by applying a relatively straightforward mathematical equation which can be estimated by carefully understanding and modeling certain important components of the mechanics of table game play.

An appropriate table games analysis needs to take into account time and motion aspects of table gaming processes, including the elements that control the speed at which dealers conduct the game. In the game of baccarat as it is played in Macau or Las Vegas, for example, the important elements are:

Blackjack Average Hands Per Hour Table

• the time the dealer takes to deal the cards;

• the time taken by the players of the Player hand and Dealer hand to expose

their results;

• the time taken by the dealer to take and pay individual wagers; and

• the time allowed for players to make subsequent wagers.

Issues like fills, credits, cash buy-ins, color changes, supervisor acknowledgements and dealer changes all have some impact on the time and execution requirements at the table. However, these are usually considerably less significant and perhaps less sensitive to variations in the number of players at the game over any reasonable time frame. For our purposes, we are going to concentrate on the number of players as the key variable in seeking out optimal table allocations under varying player demand conditions.

Using empirical observations to monitor, segregate and estimate the elements of the mechanics of the game under different playing conditions, especially with respect to the number of players at the table, will provide the basis for finding closer to true optimal solutions with respect to the table games labor question.

Such data would permit baseline calculations to estimate the average speed of the game under varying circumstances, and would allow analysts to determine how changes in the number of players affect the number of decisions per player and for the entire table over any given time period.

The game of blackjack can be used to illustrate this issue and how it might be addressed. Consider a situation where six $100 players, each planning on betting one box per round at $100 per hand, step onto the casino floor. Management’s alternatives at one extreme could be to cater to the players by having them all play at a single table with one dealer and one supervisor. At the other extreme, management could offer each player a private table with its own dealer and supervisor.

Suppose that the applicable gaming tax rate is 20 percent and the labor cost per gaming table per operating hour is $40. Which scenario provides the better return?

To be most efficient and maintain operating costs at the lowest level, management might opt for the single-table scenario. If that is the case then operating costs would be $40 rather than the alternative $240, and this is clearly more cost-efficient.

But is this solution the more profitable for the casino? Suppose that empirical observations yielded the following findings for the casino’s blackjack games. The casino’s dealers can deal a total of 350 hands per hour on average (including their own hand), and this number of hands is more or less independent of the number of players at the table. House rules are such that a perfect basic strategy player plays to a house advantage of 0.5 percent of handle. The average $100 player that the casino attracts plays a strategy about 1 percent inferior to the basic strategy, creating a 1.5 percent average house advantage for the casino.

Under these assumptions, the single table will generate 300 player hands per hour, with a total handle of $30,000 per hour, and an expected win of $450. After labor costs are computed, the contribution to income from the single table is $410.

On the other hand, the second alternative of one player per table would permit each player to make 175 wagers per hour, resulting in a handle per table of $17,500 and an expected win per table for the casino of $262.50. For the entire six tables, the expected win would be $1,575; after labor costs of $40 per table per hour are subtracted, the contribution to income for the casino from this option is $1,335 per hour, more than three times better than the one-table alternative.

In addition, players may be tempted to play more than one box. This increases the yield by increasing the proportion of the 350 of dealt hands which go the player. As will always be the case with taxes on win at a fixed percentage, the after-tax results will not change the optimal solution, and the one-table-per-player option remains more than three times better than the one-table option.

(If gaming taxes are accrued as a percentage of gaming win, it will not change the optimal number of players per table, but it will increase the required minimum average wager to make the game show positive income contribution.)

This type of simple example is often cited to demonstrate that optimal utilization is not the same as 100 percent table occupancy. In the above scenario, optimal utilization occurs with six-box blackjack tables when there would be a single player per table. (Given the assumptions, using three tables with two players each would result in hourly expected winnings per table of $350 and contribution per table of $310, for a total of $930, a third less profitable than the one-table-per-player option.)

Based on an algebraic model developed for the values assumed in the above situation, any average wager of $23 or more would call for one player per table. If the average wager was between $15 and $22, then the optimal number of players per table would be two; between $11 and $14 average wager, the optimal number of players per table is three; and at between $9 and $10 per average wager, the optimal number of players would be six. When the average wager per player drops below $9, the table cannot earn enough to cover its labor costs at $40 per hour.

What needs to be calculated for each game type and for each average wager level is the number of players at which profit per player is maximized. To do this for blackjack requires estimates of how the game’s speed of play and the number of decisions delivered to each player changes as more players join the game. For each average wager size, it is then conceptually possible to calculate the optimal utilization for that game, taking into account gaming tax rates and labor costs.

Assessing Player Skill

For blackjack, it is also necessary to assess the relative average skill for each classification of player by average wager size. For example, it is conceivable that low-limit players (with $10 average wagers) play with an average house advantage (player disadvantage) of 2 percent, whereas higher-limit players (with $100 average wagers) might play with an average player disadvantage of 1 percent.

To estimate the skill levels of different player categories, hours of observations with appropriate sampling strategies would be required to determine the average skill levels of players (based on their play strategy deviations from basic strategy).

Existing software in the casino’s surveillance department, such as the blackjack tracking tool “Bloodhound,” can calculate the casino house advantage against any player, based on actual player decisions. Such a tool could facilitate determining player skill by players grouped into average wagering level categories.

Calculations for the game of blackjack will be distinct for each market depending on tax rates, labor costs, player skills and game rules. These factors, along with dealer speed and procedural efficiencies, will affect the values of the parameters in the model. It is then a relatively straightforward task to apply the logic of the model to determine an optimal utilization rate as a function of average wager size.

Blackjack Average Hands Per Hour Crossword

Of course, players are not always so accommodating to be easily classified and segregated with respect to average wager size and skill level, so consideration needs to be given to the social aspects of table games. However, it is in the casino operator’s interests to consider how best to maximize returns in light of such realities. One simple solution might be to offer some higher-limit blackjack tables with a lesser number of playing stations than the standard six. In the same vein, the casino might change the size and shape of higher-limit tables and offer more luxurious and comfortable seating for each player.

Yet another solution might be to offer a dynamic (electronic) table with betting areas (boxes) that could be activated on demand. This could be achieved by LEDs embedded into the tables to delineate betting areas. The number of boxes could then be altered dynamically. When games are initially opened, it may make sense to have only three to five betting spots activated per table.

Betting areas could also be activated in circumstances where total demand exceeds supply at some average betting level, or where an individual higher-value player might want to play multiple boxes. Management can then get closer to optimal table utilization by considered alteration as playing conditions change. Alternatively, technology might allow the number of spots at the table to change as a matter of electronically observed playing patterns and carefully written algorithms.

Blackjack Average Hands Per Hour Poker

Harking back to the example of six $100 players and a choice of operating either six blackjack tables or one, it was shown that it was more effective to operate six individual tables as long as the players chose to play on a single table each. However, what if the players instead chose to all play together on one table?

In the example, this situation would be sub-optimal not only for the reasons found in the analysis, but also because the five inactive tables would incur an additional operating cost in aggregate of $200 per hour. Thus, part of the management challenge is to encourage the right kinds of players to spread out while discouraging lower-betting and more highly skilled players from clustering together. To some extent, this can be influenced by opening or closing tables at various minimum betting limits.

Similar calculations to the blackjack example could also be made for any other table game. Each game should be analyzed by estimating its particular mechanical characteristics and direct cost components. Such estimates should also reflect the relative change in game speed that occurs when additional players are added to a single gaming table.

For example, in Macau baccarat, there will be substantial differences for squeeze or no-squeeze games and for commission versus no-commission variants. Within the Macau gaming market, baccarat is far more relevant to consider-compared to blackjack-because of the high preference for the game among players.

To illustrate the situation, and apply a slight variation of the model for Macau baccarat, the following assumptions might be made:

Gaming Tax = 40%

Labor cost = MOP$100

House advantage = 1.35%

Decisions per hour = 55 decreasing by 3 for each additional player

(to 37 then decreasing at a lower rate as player numbers increase).

Squeeze game with standard payout structure.

This would suggest that if game speed declines in the manner assumed-as more players are playing on the same table-then, as with blackjack, it is better to spread players out across a greater number of tables. Depending on the tax rate and labor costs per hour, the minimum average wager to make the game profitable is increased by the slower play with multiple players.

For such games, this suggests rituals that slow the game, such as squeezing the cards, might need to be eliminated for relatively low-limit games in the interest of efficiency.

As with the earlier discussion, this also suggests that some higher-limit baccarat tables in Macau should be redesigned to cater to fewer players per table; smaller tables with more comfortable and luxurious chairs and better player services might produce greater returns. What is also evident is that one needs to incorporate a number of important variables to approach the optimal utilization of tables in a casino.

One more area of consideration is the existing structures and customs in a particular gaming market. For baccarat tables in Macau, for example, almost all tables currently have nine boxes, even though optimal utilization-using the principles developed in this analysis-might suggest optimal numbers of players varying from one to nine players per table, depending on average wager size and speed of the game.

This may be difficult to manage, partly because of typical player behavior in Macau. Players tend to bet together against the house and seek situations where they feel they are on a run-or a hot streak-and cluster around a single table betting sometimes three deep, so that a nine-box table might have 27 wagers with back betting, all riding on the same outcome.

While it may be optimal to eliminate that situation from a profit maximization perspective, it may not be in keeping with the motives or desires of the players, and thus any attempt to do so must be balanced carefully with how players might react.

One lesson that comes from this exercise is the importance of segregation of gaming tables by the average wager size. If the optimal number of players for high-limit wagers is one per table and for low-limit wagers is six per table, there is no circumstance where the casino should permit low-limit players to slow the rate of play at high-limit tables.

Where one draws the line really depends on the cross-over points on the “optimal number of players per table” for a given set of parameter values, and it might be hard to get to that actual result. It is also crucial for accurate management reporting and analysis to not aggregate or average data from tables with different price points.

Blackjack Average Hands Per Hour Online Poker

All of these complications noted, one can still conclude that management’s manipulation of the size, shape and congregation patterns around higher-limit tables, and its control over the average number of players per table at various wagering levels, should allow the casino to increase profitability.

That is better than allowing a lot of potential wagering to go unharvested by being too cautious in controlling the casino floor’s labor costs.

Andrew MacDonald is founder of urbino.net and is also executive vice president of gaming for Genting Berhad, based in Kuala Lumpur, Malaysia. He can be reached at [email protected]

Bill Eadington is a professor of economics and director of the Institute for the Study of Gambling and Commercial Gaming at the University of Nevada, Reno. He is an internationally recognized authority on the legalization and regulation of commercial gambling, and has written extensively on issues relating to the economic and social impacts of commercial gaming. Eadington can be reached at [email protected]